Stanford encourages employees to review and confirm medical plan coverage for 2018

Comprehensive information about medical, dental and vision plans for 2018 is now available. Stanford will offer its free employee-only coverage through Kaiser Permanente in 2018, as it did last year. Rates will increase for employees who choose plans other than Kaiser for employee-only coverage.

Open Enrollment, which begins Monday, Oct. 23, and extends through Friday, Nov. 10 (11:59 p.m. PT), is the annual opportunity for employees to make changes to their health benefits and to add or drop eligible dependents from coverage.

If employees choose not to act during Open Enrollment, their medical and dental coverage will “roll over” and reflect the 2018 premiums.

Each year, employees must re-enroll in the following plans: Health Savings Account (HSA), Health Care Flexible Spending Account (FSA) and the Dependent Day Care Flexible Spending Account (FSA). Employees who have been awarded a Child Care Subsidy Grant (CCSG) from Stanford must log into the My Benefits portal during Open Enrollment to accept the grant.

University Human Resources (UHR) provides extensive information – in printed materials, on its website, in a webinar and in Open Enrollment fairs and information sessions – so employees are able to review and confirm their health and life plans. Those who don’t review and confirm their health and life plans by Nov. 10 will have to wait until the next Open Enrollment period to make changes, unless they experience a qualifying life event, such as marriage, adding a dependent or a change to their job status.

Next year, Stanford will offer free employee-only coverage through Kaiser Permanente HMO, which is the lowest-cost plan in 2018.

Among the key changes in 2018:

- Contribution limits for Health Savings Accounts (HSAs) are increasing, both for individual-only coverage and for family coverage. Individual-only HSA limits will increase to up to $3,450 of pre-tax dollars, up from $3,400 this year; family HSA limits will increase up to $6,900 of pre-tax dollars, up from $6,750 this year.

- Contribution limits for Health Care Flexible Spending Accounts (FSA) will increase to $2,600. (While the U.S. government increased the FSA spending limit to $2,600 in late 2017, the limit changed after Stanford had programmed its benefits to the 2016 limit of $2,550.)

- Co-pays have been reduced for therapies that often require multiple visits, such as physical, speech and occupational therapy, for employees enrolled in the Stanford Health Care Alliance and exclusive provider organization (EPO) plans.

- The Delta Dental Enhanced Plan will offer a third cleaning to plan members with braces.

- To provide continuous high-quality service and fast response times, Stanford has enlisted an off-site team to answer employee questions. The off-site team will assist Stanford’s in-house benefits service team, which receives triple the volume of calls during Open Enrollment. By logging into the My Benefits portal, employees can submit an online request for assistance or chat live with a specialist who can answer questions regarding their health and life choices.

How to learn more

Visit the Open Enrollment microsite to review details about health and life benefits for 2018.

Stanford Benefits will offer Open Enrollment fairs, information sessions and webinars to help employees and retirees understand their options in 2018. Check out the full list of Open Enrollment employee events and Open Enrollment retiree events to find a date that works best for you.

The Open Enrollment fairs (Oct. 26, Oct. 30, Nov. 1, Nov. 7) for employees bring together more than a dozen Stanford providers in one room so individuals may ask questions and learn more about their services. Participating providers include Kaiser Permanente, Aetna, Blue Shield, Stanford Health Care, Health Net, Genworth, Delta Dental and Vanguard, along with Stanford BeWell, the Health Improvement Program of Stanford Medicine and the Stanford WorkLife Office. Free flu shots will also be provided at the fairs by Stanford’s Occupational Health Center.

Stanford’s staff of benefits experts will hold 10 information sessions at various campus locations between Oct. 23 and Nov. 9. Staff experts will provide an overview of Stanford’s health plans, as well as details of what’s changing and what is staying the same in 2018. Each session will close with a brief Q&A session. NOTE: Plan providers do not attend the information sessions.

What will stay the same?

Co-pays, deductibles and out-of-pocket maximum costs for active employees will stay the same in 2018, except for the decrease in co-pays for certain therapies for employees enrolled in Stanford Health Care Alliance and EPO plans.

Stanford, which offers free, employee-only coverage through the lowest-cost plan, will continue to offer that benefit to employees who enroll in the Kaiser HMO.

Stanford will also continue to offer the EPO plan, the Healthcare + Savings Plan, the ACA Basic High Deductible Health Plan and the Stanford Health Care Alliance plan.

The university continues to offer vision and dental plans as part of its comprehensive health care benefits.

BeWell – Your Employee Wellness Program

In 2018, BeWell is offering the maximum incentive to all benefits-eligible employees, whether they elect to receive medical benefits from Stanford or another organization.

All benefits-eligible employees can earn up to $560 in a taxable incentive for completing the online Stanford Health and Lifestyle Assessment (SHALA) and the following activities by Nov. 30:

- Wellness Profile ($200), which includes attending a screening session, discussing the results with a BeWell Coach and creating an online action plan that identifies wellness goals and outlines strategies for achieving them.

- Engagement ($260), for which employees choose one of the following four options: Coaching, Class, Commitment to Family/Community and Healthy Work Environment.

- Berries ($100), which are six health-related activities of the employee’s choosing that help put wellness goals into action, including exercise classes, fitness assessments and workshops.

A spouse or registered domestic partner of a benefits-eligible employee can earn a $220 taxable incentive if he or she completes the SHALA and the Wellness Profile. A spouse/registered domestic partner is only eligible to receive that incentive if the employee completes the Wellness Profile and Engagement by program deadlines and is employed by Stanford University at the time of payout (February 2019).

Why are contribution rates increasing?

The Stanford Health Care Alliance, EPO and Healthcare + Savings plans are “self-funded,” which means the university pays the claims when services are used and protects employees from being bankrupted by serious health issues.

Each year, the dollar amount Stanford spends on health care has grown. The rates reflect what the university thinks it will spend in 2018 based on the health of its employee populations and the care they will require.

Charts of contribution rates for employees and retirees can be found on the Open Enrollment microsite here.

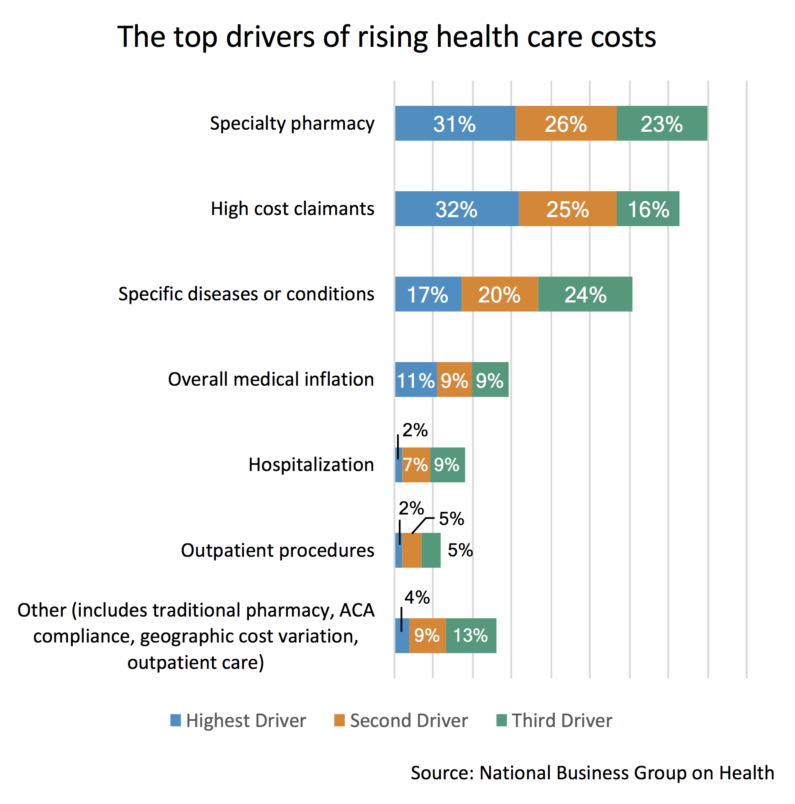

At Stanford, several factors influence the cost of health care and have a compound effect on contribution rates.

With its managed competition approach to pricing, Stanford’s contribution is based on the lowest-cost plan (Kaiser). A percentage of the cost of this plan is then used to determine how much the university will subsidize the others. As the cost of the more expensive self-funded plans rise over time, the cost to employees also rises.

“There are three forces that impact our medical plan costs: employee health and demographics, the high-cost market for medical care that we utilize and the managed competition approach that determines university contribution levels,” said Neal Evans, director of health and life benefits.

“Some of our population have serious health issues and, fortunately, they have access to world-class, but costly, health care providers. Costs of using these providers have risen sharply, while Kaiser continues to keep costs steady. As Managed Competition uses the same percentage of a fairly flat plan to offset the cost of more and more expensive plans, it has resulted in a larger amount that employees contribute.”

New My Benefits Portal

Stanford has improved My Benefits, the portal where employees may select and change health and life benefits. The upgrade makes it easier for employees to view and change their benefits on their smart phones or tablets. Retirees must call the University HR Service Team to make their elections while their access to the portal undergoes a security upgrade.